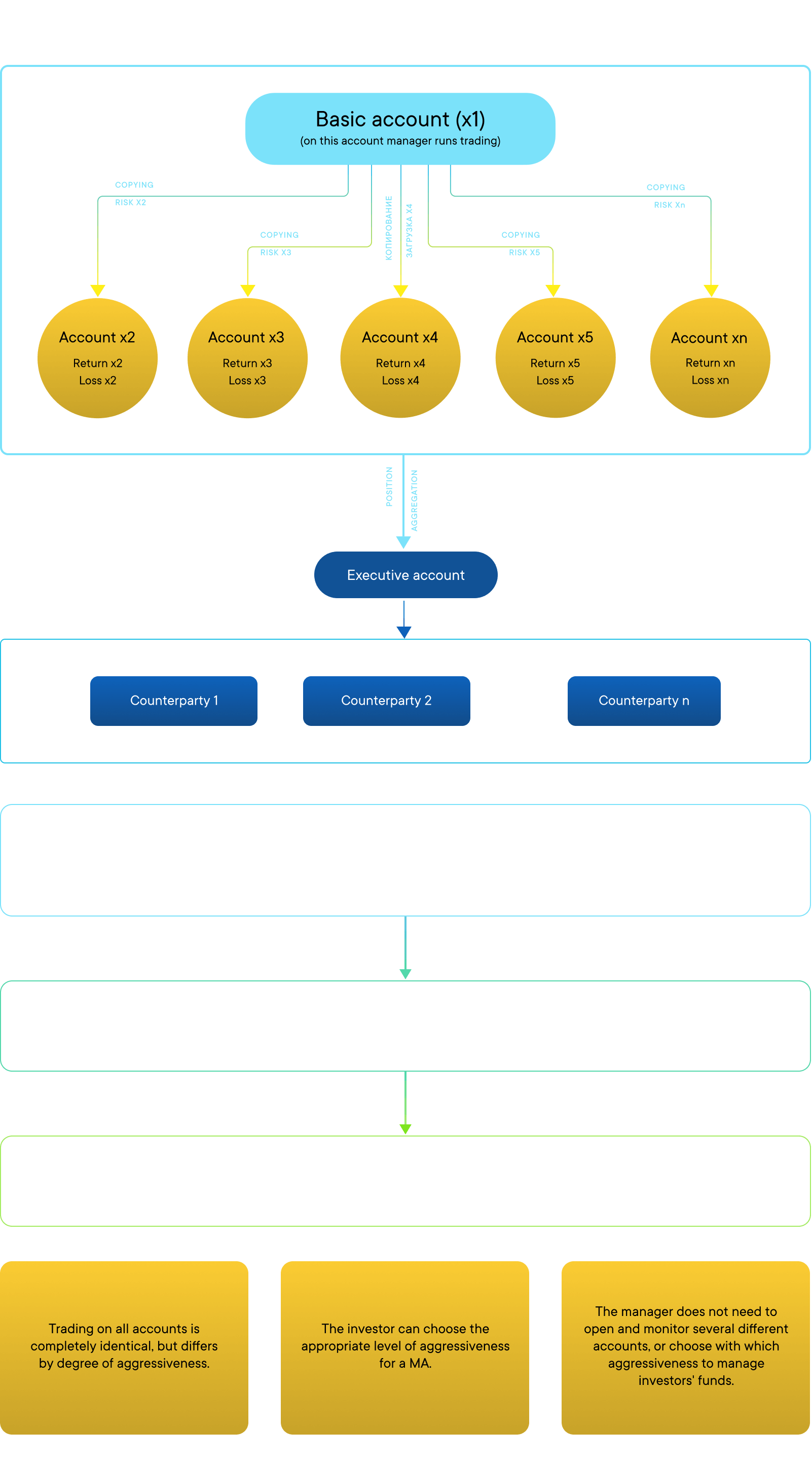

Example of managed account multiplication

Below is an example of changes in various MA parameters, broken down into a family of MA multi-copies.

| Managed account | Multiplier | Maximum losses (for the week) | Result (per trade) | Maximum leverage | Level of risk on account (per trade) |

|---|---|---|---|---|---|

| Base ("MA*1") | 1 | 10% | X (%) | 1 : 10 | 2% |

| "MA*2" | 2 | 20% | 2X (%) | 1 : 20 | 4% |

| "MA*3" | 3 | 30% | 3X (%) | 1 : 30 | 6% |

| "MA*4" | 4 | 40% | 4X (%) | 1 : 40 | 8% |

| "MA*5" | 5 | 50% | 5X (%) | 1 : 50 | 10% |

Working with multi managed accounts (Multi-MA)

For the manager:

- Agree with risk standardization;

- Agree the basic account risks with the ICE Markets risk management department;

- Deposit own funds in the manager funds of all multi-copies of the basic account.

For the investor:

For the manager

There is often a situation where some investors are ready to invest in a manager if the manager will work more aggressively, while some prefer a manager that uses more conservative trading approaches. By trading with only one level of aggressiveness, the manager inevitably loses some potential investors.

With the multiplication system, the manager is contented with the advantages inherent in accounts with varying degrees of aggressiveness and can work with all groups of investors simultaneously.

More conservative and more aggressive trades all have their pros and cons. By trading with only one level of aggressiveness, the manager inevitably loses the advantages that come with trading with different levels of aggressiveness.

In the case of applying the multiplication model, the manager does not need to maintain several accounts with different levels of aggressiveness, but at the same time, it is possible to settle for the advantages of accounts that have varying degrees of aggressiveness.

Trades opened on all multi-copies of an account are aggregated before being executed at an external counterparty. This ensures that trades are executed at a single price on all multi-copies of the account. This also eliminates discrepancy between the results of various multi-copies of the account. This cannot be achieved if the manager manages several accounts manually because execution will be segregated for each of the accounts, and the results of all accounts and their investors will differ.

For the investor

Due to the presence of multipliers, investors can invest smaller funds with the same result in absolute terms and risk smaller amounts.

The investor can invest smaller amounts in more aggressive versions of the trading system with the same results.

For low-risk trading systems, the investor is forced to keep extra funds that is not used in trading. For example, $10,000 invested in an account with multiplier "2" is equivalent to $5,000 invested in an account with multiplier "4". While "account*2" earns 5%, "account*4" earns 10%, which in both cases is $500. However, for the $5,000 invested in "account*4", the remaining $5,000 remain free. Thus, the remaining $5,000 can be invested in another asset or not invested at all.

Any investor can choose between different degrees of aggressiveness of a single trading system, thus:

- There are no such cases where the investor refuses to invest in a manager he/she likes because of non-compliance of the aggressiveness of that trader's trading system with the required level;

- Creation of a portfolio becomes more flexible and diverse.

Standardization of accounts coupled with the risk management system, allows:

- To be well guided in finding out the risks of each manager and his multi accounts, since they all have the same gradation/multiplicity;

- To calculate portfolio risks more accurately, which, at the same time, does not go against the manager's trading activity.

Note!

- Past performance does not guarantee future results. ICE Markets cannot guarantee your future results and/or success.

- ICE Markets provides only managed account service for investors and managers. The company is not a representative of any of the parties to trust management.

- ICE Markets does not participate in managing the funds of clients that are investing in managed accounts.

- Leveraged investing exposes an investor to higher risk and can lead to complete or partial loss of one's funds.

- If you do not fully understand the investment process or the degree of risk you may be exposed to, consult a third-party specialist for advice.

- The minimum amount required by a manager to open a managed account is $300.